Professionals and Pre-Retirees

The best time to start planning for your retirement was when you started working. The second-best time is now. Our team’s disciplined approach to retirement planning and investment management is designed to help you position your wealth in your working years and put your nest egg to work in meeting your goals.

High Net Worth Families

We review your tax and estate planning to create a plan designed to help you pay as little tax as possible and to build wealth that you can disburse how you choose. Whether you want your wealth to go to your family, charities, or a combination of both, we work with our partners at reputable accounting, insurance, and law firms to help you optimize your wealth transfers.

Retirees

Through intricate financial planning and investment management, we help you get where you need to go to accomplish your financial goals. Though our analysis in the background is extremely thorough, we explain our findings in layman terms and allow you to choose your own destiny.

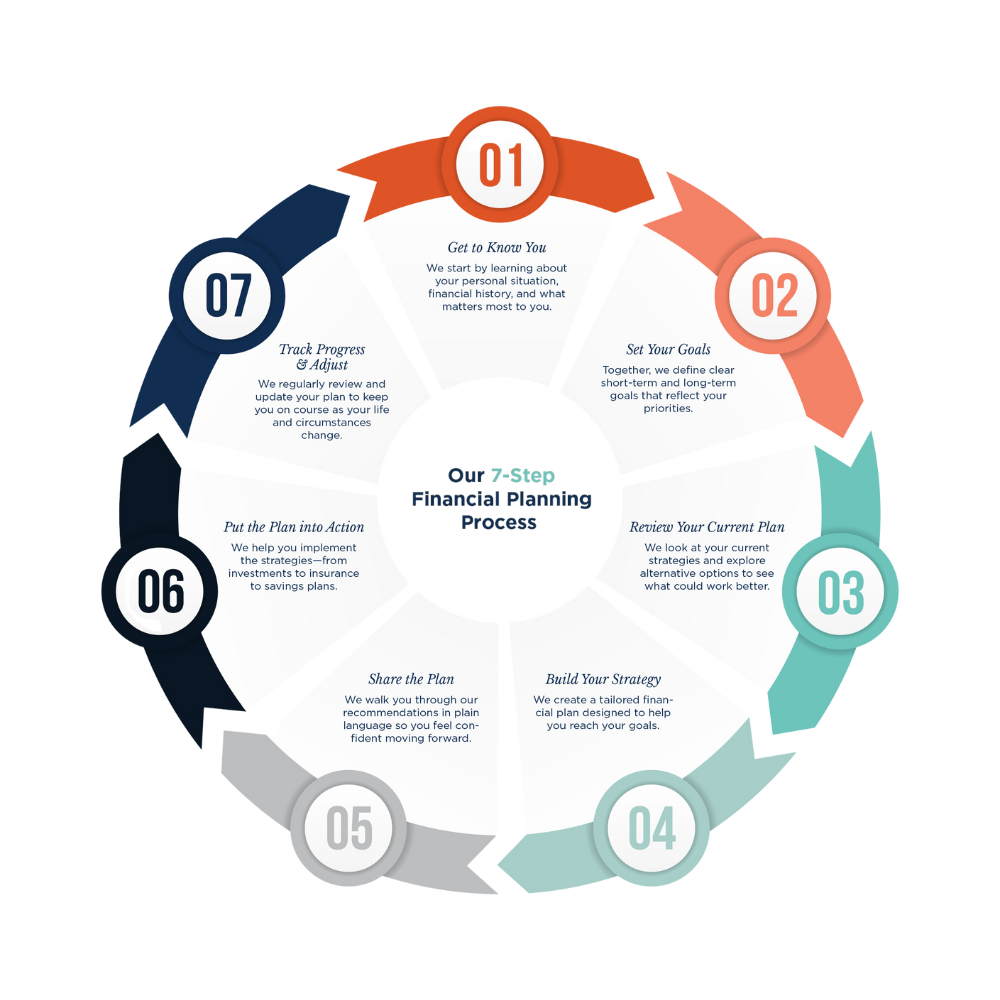

Our 7 Step Financial Planning Process

1. Get to Know You

We start by learning about your personal situation, financial history, and what matters most to you.

2. Set Your Goals

Together, we define clear short-term and long-term goals that reflect your priorities.

3. Review Your Current Plan

We look at your current strategies and explore alternative options to see what could work better.

4. Build Your Strategy

We create a tailored financial plan designed to help you reach your goals.

5. Share the Plan

We walk you through our recommendations in plain language so you feel confident moving forward.

6. Put the Plan into Action

We help you implement the strategies—from investments to insurance to savings plans.

7. Track Progress & Adjust

We regularly review and update your plan to keep you on course as your life and circumstances change.